| Open End Certificates |

|

|

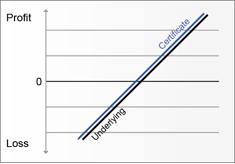

Open End Certificates are financial instruments resulting participation rate movements in an underlying asset 1:1. One-to-one ratio (1:1) is a way of expressing that the instrument exactly follows the underlying asset movements. Shape securities are certificates and "open end" indicates that the certificate does not have a fixed final date, just like a share. Examples of underlying assets may be equities, indices, commodities, interest rates, currencies or market sector.

|

|

| Market Expectations |

|

| • |

The value increases in the underlying |

|

| Properties |

|

| • |

Unlimited participation in the development of the underlying |

|

| • |

Reflects underlying price moves 1:1 (adjusted by conversion ratio and any related fees) |

|

| • |

Risk comparable to a direct investment |

|

| • |

Fees generally in the form of management fees or through the retention of payouts attributable to the underlying during the lifetime of the product |

|

|

| If you want to learn more about this instrument, you can do it at www.ndx.se/education/. |

|

|

|

|